How will the semiconductor industry be affected by the US tariff policy?

Although the US comprehensive tariff policy exempts some semiconductor imports, the high tariffs on GPUs, chip manufacturing equipment and related electronic products threaten the revival of the US semiconductor industry, and the problems caused by tariff loopholes are far beyond expectations.

The complexity of the semiconductor supply chain has increased the risk of rising costs, supply chain chaos and retaliatory tariffs from allies, which may weaken the competitiveness of the United States in the global chip market.

The United States intends to revive the US manufacturing industry through tariffs, but its effectiveness is questionable. In the short term, it may lead to price increases and innovation stagnation, and in the long term, it will need to rely on more comprehensive policy support.

Part 1 US Tariff Policy Direct Impact On The US Semiconductor Industry

In the tariff policy announced by the United States, semiconductors were included in the exemption list, which apparently eased the pressure on the industry. The exemption scope of the Harmonized Tariff Schedule (HTS) issued by the White House is narrow, covering only some advanced chips (such as HTS code 8542.31), while key categories such as GPUs (8473.30), servers (8471.50) and chip manufacturing equipment are not exempted.

Directly imported bare chips are tax-free, but packaged electronic products and production equipment still need to bear tariffs of up to 49%. Take Nvidia as an example. Among its more than 1,300 products, only about 20% may be tax-free, and AI core hardware such as DGX servers will face significant cost increases.

Semiconductors mostly enter the United States in the form of finished products (such as smartphones and servers). The tariff is actually equivalent to a comprehensive tax rate of about 40% on these products, which will indirectly push up consumer prices and weaken the cost competitiveness of American companies in AI, cloud computing and other fields.

Semiconductors are the cornerstone of AI development, especially Nvidia's high-end GPUs are indispensable in training large models.

◎ If the US tariffs are fully implemented, it will significantly increase the cost of GPUs and servers, directly affecting the progress of US data center construction and AI model training.

◎ The tariff loopholes of chip manufacturing equipment (such as lithography machines) are particularly critical. The world's most advanced lithography machines are mainly produced by ASML of the Netherlands (20% tariff) and Tokyo Electron of Japan (24% tariff). If the import cost surges, the procurement of equipment for new wafer fabs in the United States will face greater pressure.

This runs counter to the goal of manufacturing repatriation promoted by the CHIPS Act. The tariff policy may be counterproductive and delay the improvement of domestic production capacity.

The semiconductor industry is highly dependent on macroeconomic health, and its products are widely used in consumer goods such as automobiles and home appliances. Rasgon pointed out that the price increase caused by tariffs will affect downstream industries, and consumers may face increased costs for goods such as smartphones and cars.

If the traditional chips that the automotive industry relies on increase in price due to tariffs, it may offset the production repatriation benefits brought by the CHIPS Act. Tariffs on raw materials (such as steel, aluminum) and electronic components further push up manufacturing costs, forming a typical tariff dilemma of "upstream benefits and downstream losses".

The global nature of the semiconductor supply chain makes it difficult for unilateral tariffs to achieve the expected effect, and may weaken the United States' leadership in the high-tech field.

Part 2 The Impact Of Tariff Policies On The Global Supply Chain Cnd US Strategic Goals

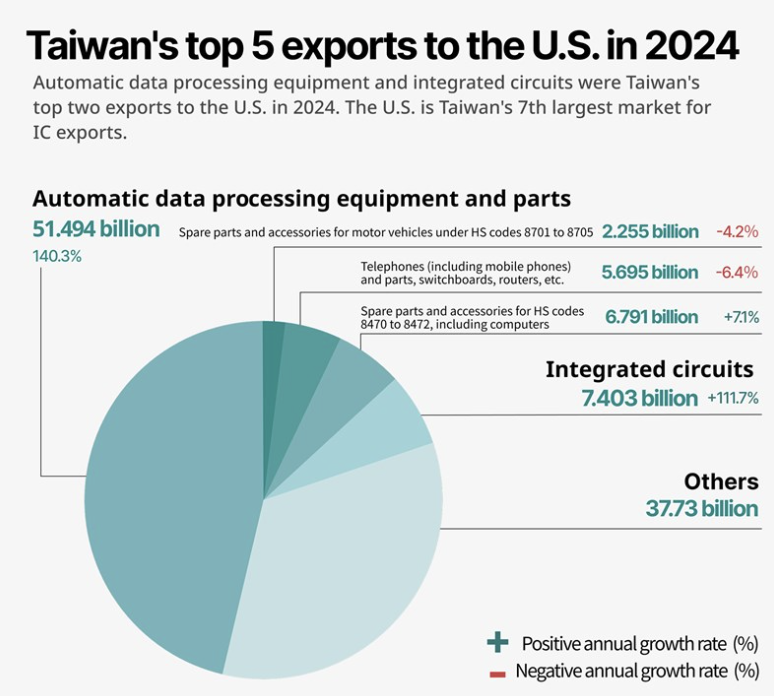

US tariffs cover many US allies, such as Taiwan (32%), Japan (24%) and the Netherlands (20%), which play a key role in the semiconductor supply chain.

◎ Taiwan's TSMC produces more than 90% of the world's advanced chips. Bare chips are tax-free, but its exported finished products such as servers will face high tariffs. Taiwan's low-profit server manufacturers may be forced to raise prices, pushing up the cost of US AI infrastructure.

◎ Southeast Asian countries such as Vietnam (46% tariff) and Thailand (36% tariff) have also been hit hard.

These countries have become popular destinations for chip manufacturing outsourcing in recent years. High tariffs may prevent companies such as Intel and Micron from moving production from China to here. Supply chain disruptions will be "long-term and painful" and may trigger global economic turmoil.

The United States claims that tariffs are aimed at bringing manufacturing back to the United States, but the complexity of the semiconductor industry makes it difficult to achieve quickly.

Data from the Semiconductor Industry Association shows that chip sales in the Americas will increase by 48.4% between 2023 and 2024, far exceeding China (5.6%) and Europe (-8.1%), indicating that reshoring has made progress. The United States only accounts for 12% of global production capacity, far lower than 37% in 1990.

The Chip Act invested $52 billion to try to reverse the decline, but it will take several years to build a new wafer fab and it will rely on imported equipment and raw materials. Although tariffs may encourage some companies to invest in the United States, the rising costs of equipment such as lithography machines will offset the attraction.

Joe Zempa pointed out that semiconductor manufacturing involves more than 500 decision-making factors, tariffs are only one of them, and talent, tax policies and infrastructure are more critical. If the United States ignores these comprehensive factors, it may be difficult to achieve its goals by relying solely on tariffs, and it may weaken the return on existing investments.

The "Liberation Day" tariffs implemented by the United States under the International Emergency Economic Powers Act, including a general tariff of 10% and reciprocal tariffs on 60 countries (such as China's 54%), mark the full return of protectionism, which will push up global inflation and harm consumer interests.

China has promised to "resolutely counter", and other countries such as Canada and Mexico may also take retaliatory measures, leading to an escalation of the trade war.

The global nature of the semiconductor supply chain makes it particularly vulnerable, and high tariffs may lead to an intensification of the trend of regionalized production and weaken the dominance of the United States.

Summary

The US tariff policy aims to revive the US semiconductor industry through trade barriers. The contradictory design of narrow exemptions and comprehensive taxation is threatening the realization of this goal.

Supply chain chaos and the risk of retaliation from allies are weakening the US competitiveness in AI and high-tech fields. In the short term, consumers will suffer from rising prices, and companies will face shrinking returns on investment; in the long term, the return of manufacturing needs to rely on comprehensive support such as the "CHIP Act" rather than relying solely on tariffs.

The gamble may bring local job growth to the United States, but it may also come at the cost of stagnant innovation and global isolation. In the game of semiconductors, the lifeblood of the modern economy, the United States needs to carefully balance short-term gains and long-term strategies, otherwise the dream of revival may become empty talk.